In Texas Civil Asset Forfeiture, government action is taken against a person's property or assets, not against their rightful owner. A person's property is the target of the legal proceeding, and not the owner where the government seeks to take that property deeming it "contraband." While often in conjunction with a criminal prosecution the owner does not have to be arrested or convicted of a crime to have his property taken.

In 1989, the Texas Legislature enacted Chapter 59 of the Texas Code of Criminal Procedure. With the enactment of this statute the Texas Legislature had two primary goals: The first goal was to broaden the scope of forfeiture by significantly expanding the list of predicate crimes; and the second goal was to provide guidelines for the use and oversight of forfeited property. Since the enactment of this statute the first goal has no doubt clearly been met or exceed by the legislature with over $486 million in assets seized and taken from citizens by state and local officials.

However the second goal has been a dismal failure due to gaping holes left in agency reporting requirements and categories left so broad it's impossible to detect abuse. Widespread abuse and mismanagement of these ill-gotten assets are being reported. While these funds are supposed to be used for law enforcement purpose District attorneys have been using these funds to purchase alcohol and Margarita machines; fund lavish trips; space to purchase commercials for District Attorney Re-election campaigns and one Dist. Atty. even distributed $1.1 million to his favored employees over a three-year period.

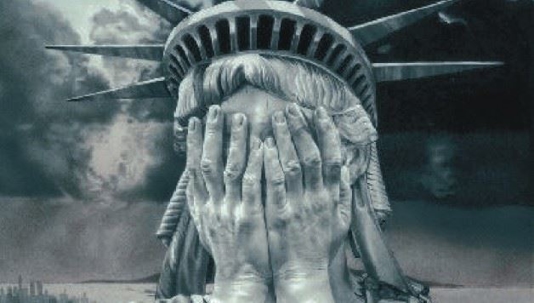

Sadly, these are the same people that are charged with the responsibility of ensuring that the seizures against citizens are lawfully sound, just, and reasonable. The Texas legislature has effectively put the fox in charge of the chicken coop.

The statute allowing asset forfeitures in Texas authorizes the police to seize cash and other assets under one of the following scenarios. The cash or property must fall into one of three categories: (1) facilitating property; (2) use property; and (3) proceeds property. Facilitating property is broken into two categories. Property used in the commission of criminal offenses excluding drug offenses; and property used in the commission of drug offenses.

For property that is not used in the commission of drug offenses it includes property used in the commission of any first or second degree felony under the Texas Penal Code or any felony regardless of classification if it includes robbery; burglary; theft; fraud; computer crimes; telecommunications crimes; insurance fraud; criminal solicitation of minors; indecency with a child; evading arrest her attention detention (which can make a vehicle used to evade arrest or detention under a state jail felony forfeitable); sexual performance by a child; and child pornography.

Also property used in the commission of securities violations (such as the sale of unregistered securities) are subject to forfeiture. Another form of facilitating property that is subject to forfeiture is property loosely associated with drug crimes. These can include drug offenses and money laundering offenses. Also property involved in misdemeanor illegal dumping offenses is forfeitable.

The seizures can include vehicles, currency and negotiable instruments and investments, vehicles, and real property such as homes and land. In drug cases, frequently the police spend more time inside a home looking for valuables and documents indicating valuable assets (such as titles, bank statements, deeds, etc.) than the actual drugs they are allegedly seeking.

There are defenses against forfeiture. The first and most common probably used is the innocent owner defense. This is often used in instances when a vehicle or conveyance owned by another with no knowledge of what is occurring is used in the commission of a crime. To utilize this defense the owner must've acquired their interest in the seized property prior to the illegal acts and did not know nor should not reasonably have known of the illegal act at or before the time they acquired the property.

Or if they acquired the interest in the property after the illegal act they must not have known or reasonably should have known of the illegal act at the time they acquired the interest in the property. Texas homestead laws do not afford a defense to an owner of seized property since forfeiture is not a debt. And the community property statutes in Texas do not afford protections to an innocent spouse regardless of any lack of knowledge by the spouse. The only exception to this rule is where the innocent spouse was kept from preventing the illegal act or use of the property by an act of violence by the guilty spouse. Also procedural tactics can be employed against Texas Civil Asset Forfeitures.

A peace officer who seizes property is required to provide the attorney representing the state with a sworn statement containing an inventory of the property seized within 72 hours of the seizure. Also, subsections (a) and (b) of Article 59.04 requires that a notice of seizure and intended forfeiture (the lawsuit) be filed within 30 days or the court loses jurisdiction to hear the case. This, however, has often been little help to the rightful owner of a modestly priced automobile that has racked-up towing and storage fees more than the vehicle is worth by the time it became apparent the state had no intention of prosecuting the forfeiture.

Also some seized assets may be relieved under Article 59.02. Any property other than evidence in the criminal prosecution, money, negotiable instruments, or security that is seized may be retrieved by the rightful owner or interest holder upon execution of a bond in an amount worth the value of the property.

Most people in Texas that been subjected asset forfeiture do not fight to recover the money or property. The statute is structured in such a way that once a law enforcement officer makes an allegation the burden shifts to the owner of the accused property to prove that it does not fall within one of the above categories. Unlike the companion criminal statutes the owner of the property is not entitled to the appointment of an attorney. Once the owner of the accused property has had all their liquid assets seized, and their bank accounts seized, few can afford to put up a fight.

Therefore these abuses by government officials occur. The burden of proof the state must meet in an asset forfeiture is the same as in other civil trials, a preponderance of the evidence. Meaning the government must show it is more likely than not their allegations are true. And in asset forfeiture proceedings like all civil proceedings the state has the power to conduct full discovery including the power to take the deposition of the property owner. By filing the civil proceedings the state is able to end run the Fifth Amendment protections of the United States Constitution.

The Texas legislature has effectively given law enforcement and unscrupulous prosecutor's license to steal from the citizens throughout the state of Texas. And stealing they are. One of the most prolific law enforcement entities engaging in these practices have become the Texas Department of Public Safety, or more commonly known as the Highway Patrol. They are aggressively looking for motorists to stop on what they have "deemed drug trafficking corridors" and engaging in often unconstitutional and illegal roadside stops, interrogations, and searches.

In recent months the number of victims of came forward and alleged they were sexually assaulted by state troopers under the guise of conducting unlawful "body cavity searches" on the side of the roadway allegedly looking for drugs. These claims by citizens are well supported and documented by video evidence taken from the trooper's cars and these videos are widely available on YouTube.

The fourth amendment to the United States Constitution guarantees citizens the right to travel unmolested by law enforcement unless the officer has probable cause or reasonable suspicion for the stop. State Troopers who have sworn to uphold and defend the Constitution are being taught to find creative and unlawful ways to violate it by fabricating reasons to stop innocent motorist, unlawfully extending the duration of the stop, and looking for opportunities to exploit or fabricate probable cause to conduct research in this perverse pursuit of ill-gotten money which the agency shares in the proceeds. In approximately half of these roadside "asset forfeitures" no criminal prosecution is brought.